Olympus DAO: Mechanisms & Valuation

Introduction

Olympus DAO spawned the “DeFi 2.0” meme, pioneered protocol-owned-liquidity, ran to $4B market cap (and back down to $1B), got forked 69 times, and now everyone either hates it or loves it (mostly hates it as of late).

So, how does it work? Is it a ponzi? What is fair valuation? Am I gonna make it?

The only way to actually answer any of these questions is to dissect the protocol, understand its mechanisms, and then reason up from there. Let’s do that. But first, what is Olympus trying to do anyway? What is the high-level goal? What is it?

Disclosure: I have a small amount of OHM. I used to have a lot more, but sold ~90% of it in October 2021 because I thought the premium above treasury value was too high (which turned out to be a good call).

TL;DR

How Olympus works: The treasury holds a bunch of valuable assets, and bonds pull more assets into the treasury. The whole 9000% APY rebasing mechanism is mostly irrelevant.

How to value OHM: token value should be based on the treasury — both its current value, and its future expected value. The expected future treasury value should be discounted back to the present, and further discounted for risk/uncertainty. The premium above treasury value that OHM trades at essentially indicates a rational market’s projection of future treasury value. So, to value OHM you need a projection for the treasury growth. If you think the premium is underestimating that growth then buy (not financial advice, might be psyop).

Problem & Solution

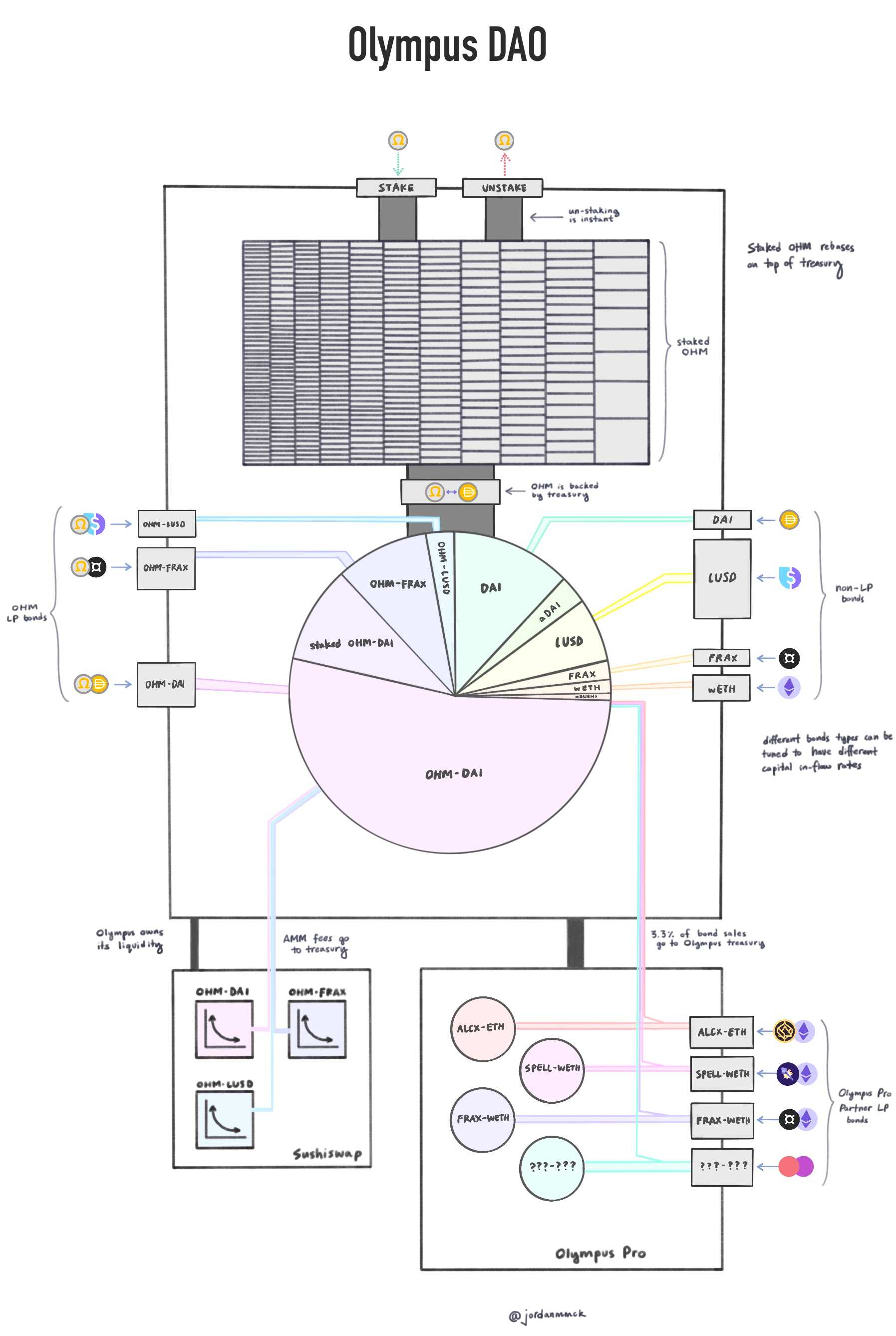

DeFi, and crypto more broadly, needs its own reserve currency. We need a stable currency that we can store value and price assets in, that isn’t tied to fiat.

What’s wrong with fiat stablecoins? Well, first of all they aren’t really stable. Every fiat-pegged/backed stablecoin is debased at the whim of its corresponding central bank. DAI, USDC, USDT, and every other USD-stablecoin’s value is diluted when The Fed prints money. Shouldn’t we have a currency that is actually stable against some CPI-like metric or something?

And secondly, we’re just asking for trouble bringing fiat into cryptoland, especially USD. The dollar is very precious to the US Government. USD-stables like DAI are arguably bullish for dollar dominance, but regulators may not see that… Let’s not poke the bear any more than necessary.

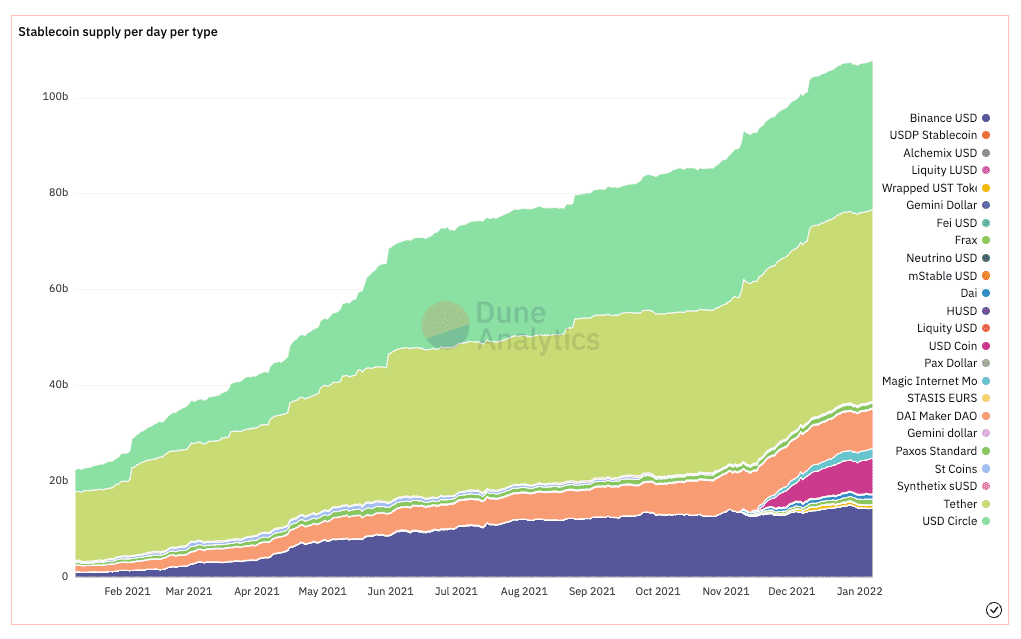

The goal of Olympus DAO, and the solution it aims to present, is to build the decentralized “central bank” of crypto. On top of this central bank sits OHM, an eventually stable (but not pegged), asset-backed, algorithmic currency. The potential here is huge obviously. Stables are already $100B+, and the long-term TAM is somewhere in the trillions.

OHM is certainly not stable right now though, but that’s because we’re in the growth phase. Eventually we enter the stability phase, at which point (in theory) OHM matures into the stable, nuke-proof foundation for DeFi.

OK, how does all this work?

Architecture & Mechanisms

I’ll try to explain things starting at a high-level and zooming-in (low-res to high-res), rather than progressively scanning each component in high detail.

A very simple, high-level description of Olympus DAO might be,

Olympus DAO consists of a treasury with a token on top, and some mechanisms which aim to continually grow the treasury.

Zooming-in a bit…

We have the treasury at the center of the system. The treasury has various assets in it. Then, we have the OHM token “on top” of the treasury. Bonds sit “alongside” the treasury, and serve to pull assets into the treasury. And finally there’s Olympus Pro and a couple other things, but the gist is that OHM is backed by a treasury which grows its holdings via bonds.

The diagram below attempts to capture all the major components and mechanisms. Let’s do a quick overview before going into each component more deeply.

OK, so at the heart of the system we have the treasury. Notice that the treasury has a mix of asset types, namely: liquidity provider (LP) tokens, stablecoins, and non-stable assets.

Above the treasury we have staked OHM. This OHM is connected to the treasury via that OHM-DAI bridge. This is indicating the backing mechanism wherein the protocol will buy OHM for 1 DAI in an emergency (note, this backing applies to all OHM, not just staked OHM). Finally, at the top of the staked supply box we have the simple stake and unstake entrance/exit.

OK, then we have bonds on the left and right. This is primarily how the treasury grows. Bonds function like a vending machine with a time-delay. Input DAI into the treasury, wait X days, get OHM; input OHM-FRAX-LP, wait X days, get OHM.

Then there’s the LP box down on the bottom left. That’s just showing that since the treasury owns LP shares, it earns the LP fees from the AMM for those trading pairs — just like any normal Uniswap/Sushiswap LP would.

Olympus Pro is on the bottom right. Olympus Pro offers the bonding system as a service to other protocols. So a protocol like Alchemix (and others) can use Olympus’ bonding system for their own treasury growth, and Olympus will take 3.3% of those in-flows as a fee.

OK, now zooming in more.

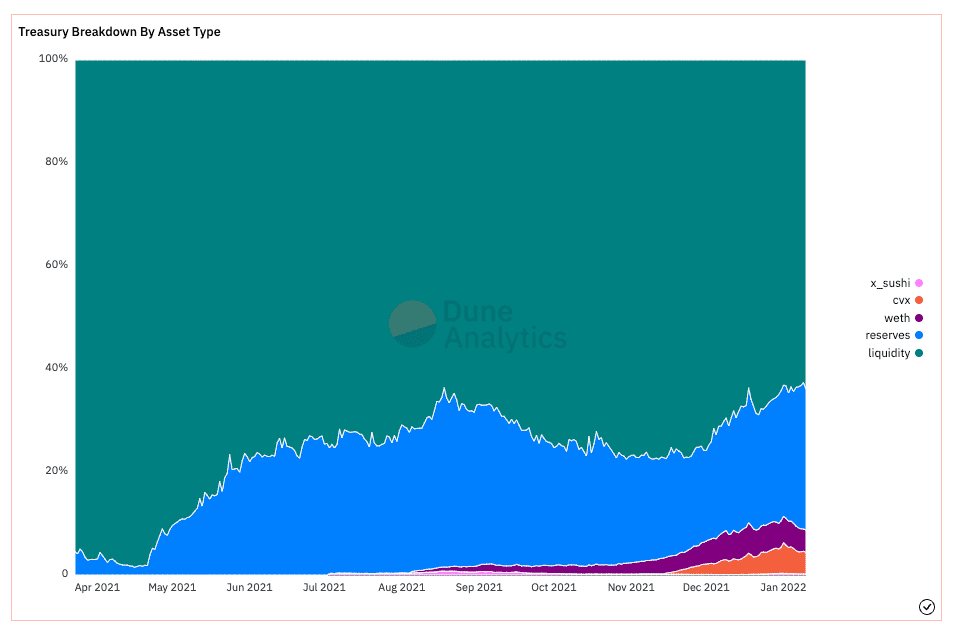

The Treasury

The treasury itself is pretty simple. Currently it has stablecoins, non-stable assets and LP shares. For stables we have DAI, FRAX, and LUSD (and some aDAI which is DAI lent out in Aave earning interest). We have some non-stable assets, right now mostly ETH, but there’s a growing set of Olympus Pro assets in there too. Then we have LP shares which of course represent a share of some assets in an AMM liquidity pool in Uniswap or Sushiswap. LP trading fees earned by these tokens are captured in the treasury.

What’s the point of having different assets anyway? Why not back OHM entirely by USD stables, or entirely by ETH? Well, one of the major goals for the Olympus treasury is diversification. Treasury diversification is crucial to Olympus’ goal of becoming a stable, robust, rock-solid, foundation of DeFi.

A basket of diverse, uncorrelated assets will be maximally resilient to the widest range of market conditions. Eventually I would expect the treasury to diversify into all asset classes, including (one day) “real-world” assets like tokenized real-estate, equities, various derivatives and maybe even precious metals. The only way a diverse set of uncorrelated assets really gets nuked is if everything gets nuked — which should only happen in wide-scale catastrophe.

This is what we want — not wide-scale catastrophe, but nuke-proof money. We want a rock solid foundation for our new financial system.

Protocol-Owned Liquidity

The fact that Olympus owns LP shares is pretty important too. This was the big “protocol-owned liquidity” innovation. Since the protocol holds those LP tokens, that liquidity is permanent, it’s never going to rug. Most protocols continually pay LPs with their native token emission/inflation — they rent their liquidity. Olympus buys and owns its liquidity. This way the protocol earns all trading fees, guarantees liquidity, and doesn’t have to continually pay LPs by inflating OHM supply. Olympus controls a lot of liquidity.

The downside to this protocol-owned liquidity is that since the LP tokens are OHM paired with another asset, the Olympus treasury ends up owning a lot of OHM. So the protocol sort of backs itself. If OHM crashes then the treasury loses value because it holds a bunch of OHM, and that causes OHM to drop in value even more since it’s now backed by less value — so it’s a bit reflexive, which is not ideal. In the long-term this may not be an issue though if the protocol-owned liquidity is like 1% of the treasury value. We’ll see.

Bonding Mechanism

So how do assets get into the treasury to begin with? This is where bonds come in. Bonds allow OHM to be purchased at a discount, with the assets spent going directly into the treasury. The catch is that you don’t get access to the OHM you buy until the bond matures, and you have to pay with one of the assets that the treasury wants.

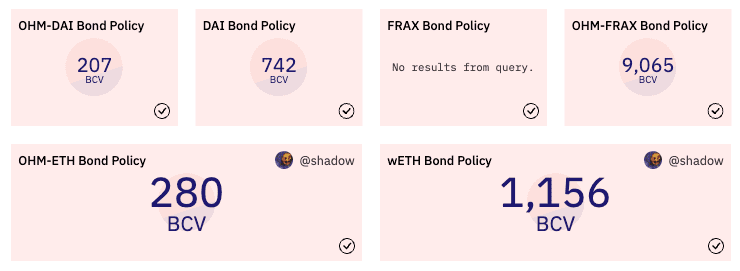

The ultimate goal here is of course to grow the treasury, but we want to grow it at a sustainable rate, and we want to be able to adjust treasury composition over time. Both of these objectives are accomplished with the bond control variables (BCVs).

Each bond type has an associated BCV (which is just a simple number) that can be adjusted to increase or decrease the discount on that bond type. A large discount will result in increased capital in-flow, and a small discount will reduce in-flow. A given BCV can be set to zero, or even a negative number, at which point all in-flows for that bond type should cease. We can increase the in-flow for wETH, for example, by adjusting its BCV, and we can reduce the in-flow for DAI by adjusting its BCV.

So we can increase or decrease the capital in-flows for the various bond types by tweaking their BCVs. We can also reduce overall bond in-flow by tweaking all the BCVs. For example, if we wanted to reduce the total treasury in-flows by half we could reduce the in-flows for each individual bond type by half. The bonds therefore function like treasury in-flow “pipes” with the BCVs functioning as “regulator valves”.

We should be precise about what is meant by “capital in-flow rate” though. Bond prices are determined dynamically. It’s not as if we set a BCV to give a 10% discount, and then those bonds can be purchased endlessly at that discount. If that were the case capital could flow in without limit via that bond. Instead each bond effectively has some throughput as determined by its BCV and the overall debt ratio. The debt ratio is the ratio between OHM currently owed to bonders and the overall OHM supply. As more bonds are purchased the discount decreases and bond prices rise. Once these bonds mature and the OHM is paid out to bonders, the debt clears and bonds become cheap again. So, the BCVs and debt ratio together set an overall bond in-flow rate that is relative to the OHM supply and indirectly relative to the treasury size as well (because the total OHM supply is correlated with treasury growth). Therefore the treasury will tend to grow at some percentage growth rate, for example 1% per week, and not some absolute rate, for example a fixed $5M per week.

bond_price = 1 + BCV * debt_ratio

debt_ratio = (ohm_outstanding / ohm_supply)

bond_price = 1 + BCV * (ohm_outstanding / ohm_supply)Bonds provide one more key mechanism for Olympus. Because OHM purchased through bonds unlock over some duration, bonds function a bit like call options. If you think OHM is overpriced and due for correction, you should probably not purchase bonds. You should wait for the market to correct first, then buy at that point. This results in treasury in-flows slowing down when the OHM market gets overheated. So the time-delay aspect of the bonds creates a sort of market-driven down-regulation of treasury in-flows when OHM price rallies hard and becomes over-extended.

So, in summary we have these treasury in-flow pipes, each with its associated BCV regulator setting the relative in-flow rate for that bond, then we have this secondary market-driven regulator which decreases overall in-flow whenever OHM price gets over-extended. These mechanisms allow for Olympus treasury to grow at a sustainable rate, and with the desired asset composition.

V2 Bonds

Everything described above is accurate for V1 bonds, but Olympus is moving (or has moved by now) to V2 bonds. All of the key dynamics described above remain, but with some improvements.

Bonds will now be isolated offerings. What that means is that bonds will be created by the Olympus team with all their parameters fixed and with some predefined limit on how much capital can go through them. So, a wETH bond may be created with some specific BCV determining its relative discount, and a maximum lifetime throughput set in either wETH terms or OHM terms. For example, the wETH bond might allow a maximum 1000 wETH to go through it, and upon hitting that limit it stops working. If the team decides we want more wETH after that, they just create a new bond with new parameters.

Bonds will also move away from linear vesting. In V1 bonds would vest their OHM to the buyer linearly over time. In V2 the entire OHM balance owed to the bonder will be paid out all at once at the end of the term.

V2 bonds can also be fixed-term or fixed-expiration. Fixed-term means the bond duration is always X days from the time of purchase. Fixed-expiry means some set of bonds all mature on some specific date.

More about V2 bonds here.

OHM Staking & Rebasing

Now onto that absurd APY that everyone gets hyped or argues about. This rebasing mechanism serves some purpose, but those APY figures are wildly misunderstood, and often misrepresented.

I’m making 9000% APY!

No you’re not. Well you are, but you’re making 9000% APY in OHM terms, not USD terms! The OHM token is rebasing at 9000% APY, so if you are staking, you are increasing your OHM stack at that rate. But you are only getting 9000% in USD terms if OHM price does not decline for the duration. There’s nothing stopping the OHM price from falling at the same rate that your OHM stack is increasing, in which case you would be flat in USD terms.

I’ll talk about OHM valuation in more depth in the next section, but to make sense of the rebasing we have to cover it a bit here.

OHM has value because the treasury has value. The treasury has valuable assets in it, OHM is backed by the treasury, therefore OHM has value. Without the treasury OHM would just be another random ERC20. The rebasing mechanism itself doesn’t add any real value. It’s all about the treasury.

OHM also exposes holders to future treasury growth. OHM trades around 2-5x the market value of the underlying treasury assets. If holding (and staking) OHM didn’t give you exposure to future treasury growth then it would trade maybe a couple percent above the value of the underlying assets, and the token would essentially be a sort of DeFi index. This exposure to future treasury growth is key.

So, holding OHM gives you de facto ownership of some chunk of the treasury, and staking OHM gives you exposure to treasury growth. But how?

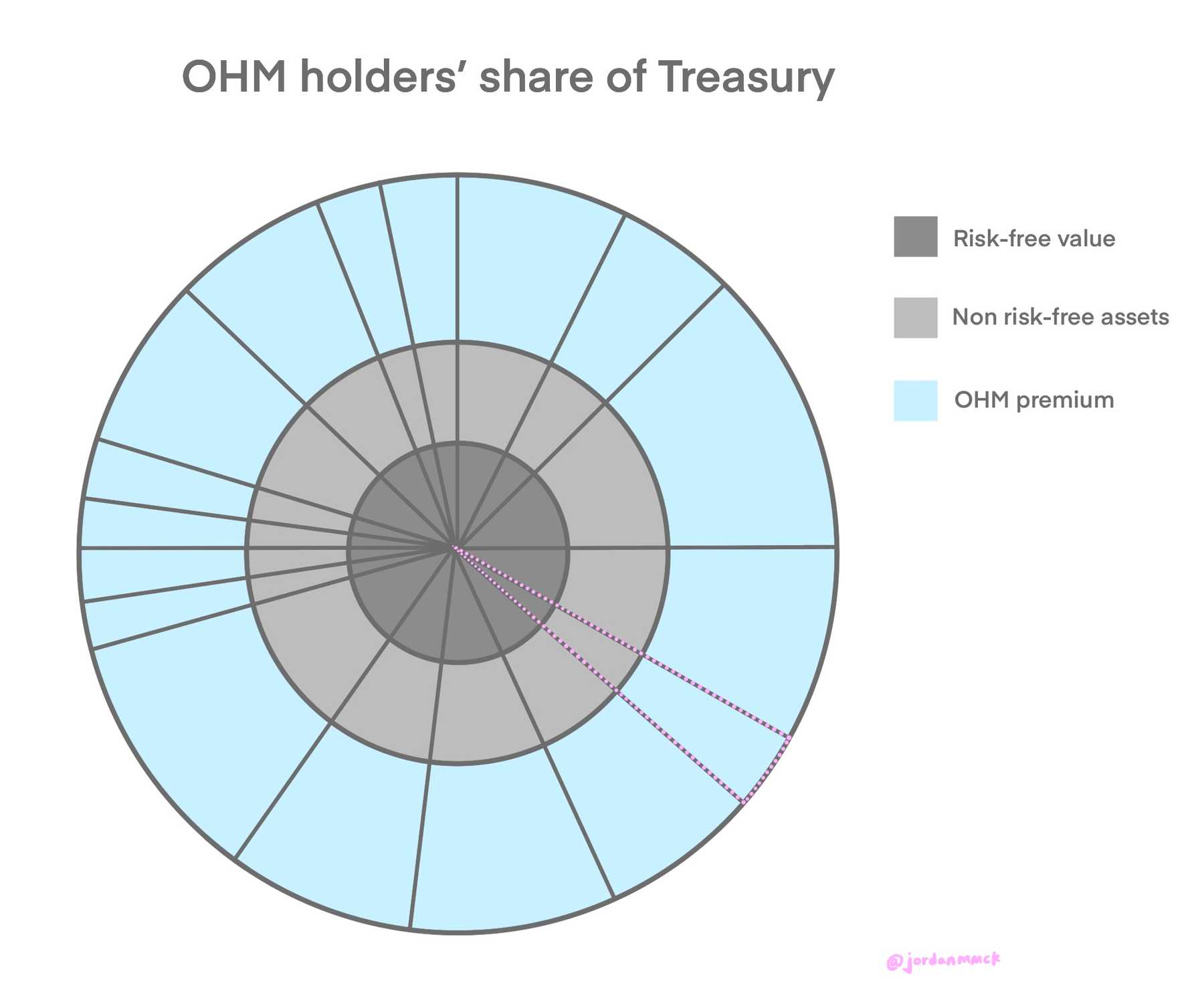

Well, I made the diagram below to help make sense of this. The total area of the chart represents the total OHM market cap. The gray circles in the center represent the treasury, with the innermost dark-gray circle representing the value of the risk-free assets. The blue area represents the premium above treasury value that OHM trades at.

So, if OHM price increases — or if supply increases and price stays flat — the blue area would grow and push out the perimeter of the circle, thereby increasing the total area of the circle. If the treasury grows then the gray circles grow.

So, each OHM holder owns a slice of this pie. Suppose you own $100K worth of the total OHM supply at a given snapshot in time. You would then de facto own about $30K worth of gray treasury assets ($10K of that being risk-free), and then about $70K worth of blue “empty space” — the OHM premium. Make sense?

Now suppose a whale comes in and buys $10M worth of OHM via bonds. We add a new slice to the pie, as outlined in pink. That pie slice is worth $10M, as it has $10M worth of “area”, but again, this newly created OHM is only backed by $3M worth of actual assets. So, $3M of that buyer’s capital in-flow essentially went to backing the new OHM they received, but the other $7M still went into the treasury. This is how OHM stakers make money, and this is the basic ponzinomic mechanism of Olympus. That $7M went into the treasury as profit and made everyone else’s pie slice slightly more valuable.

That’s really all there is to it. The rebasing mechanism is sort of irrelevant to be honest. All it’s doing is dividing up your pie slice (and everyone else’s) into more pieces, but you’re not necessarily gaining or losing any actual area when this happens.

The only way you gain area is if the treasury grows thanks to bond profits, Olympus Pro revenue, or rising treasury asset prices — or if the market bids up the premium on OHM… But actually, the market doesn’t really need to “bid up” OHM price in order for your pie slice to grow, does it? If the market simply holds OHM price flat stakers will gain area (money) thanks to the rebasing. Your OHM supply grows at 9000% APY or whatever, so a flat OHM price is functionally equivalent to a constant supply OHM appreciating in price at 9000% APY. As long as OHM price does not fall at the same (or greater) rate that supply increases, then stakers make money.

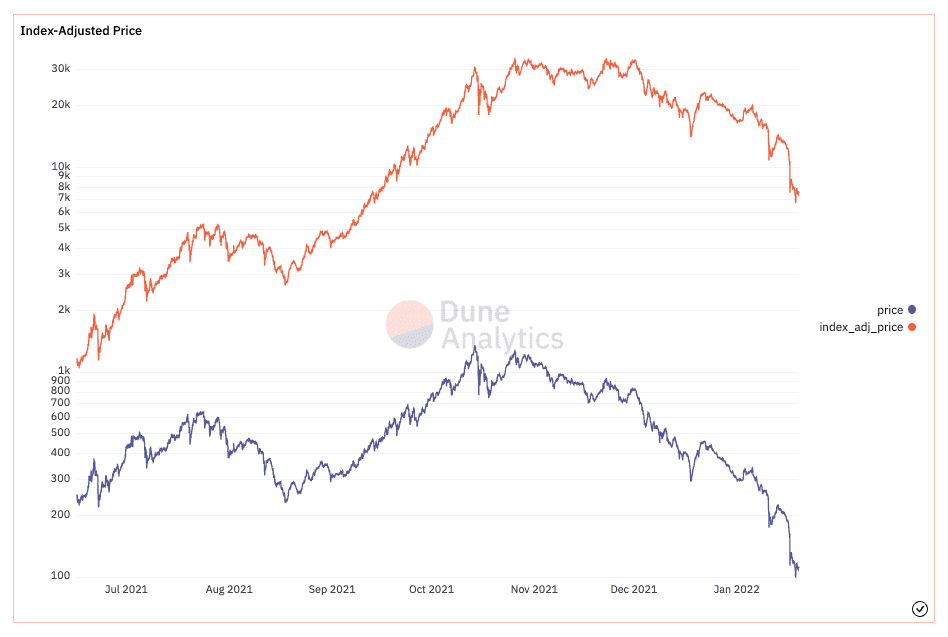

And this is the real purpose of the rebasing mechanism as far as I can tell — it obscures appreciation, it keeps token price relatively flat and palatable for buyers and bonders… Look at the chart below (log scale). The orange line is essentially what the OHM price would be if there were no rebasing. Do you think OHM would have rallied from $1000 to $32K per token in 6 months without rebasing? I doubt it. Who wants to buy a $32K token? Unit bias is real, look at YFI. The rebasing kept the price in a much more attractive $200-$1000 range.

I’m not attacking Olympus here though. Rebasing is fine. Why fight unit bias? But the 9000% APY stuff was a bit misleading. Maybe it should not have been advertised as if it were a “real” 9000% APY. On the other hand, nothing was hidden, anyone could have read the docs and figured it out.

OHM Valuation

So, how do we value OHM? Should we buy, or should we sell?

We should buy if we think price will go up — actually, rebasing makes the price somewhat irrelevant — we should buy if we think market cap will go up. Yes, obviously! But how do we know if market cap will go up?!

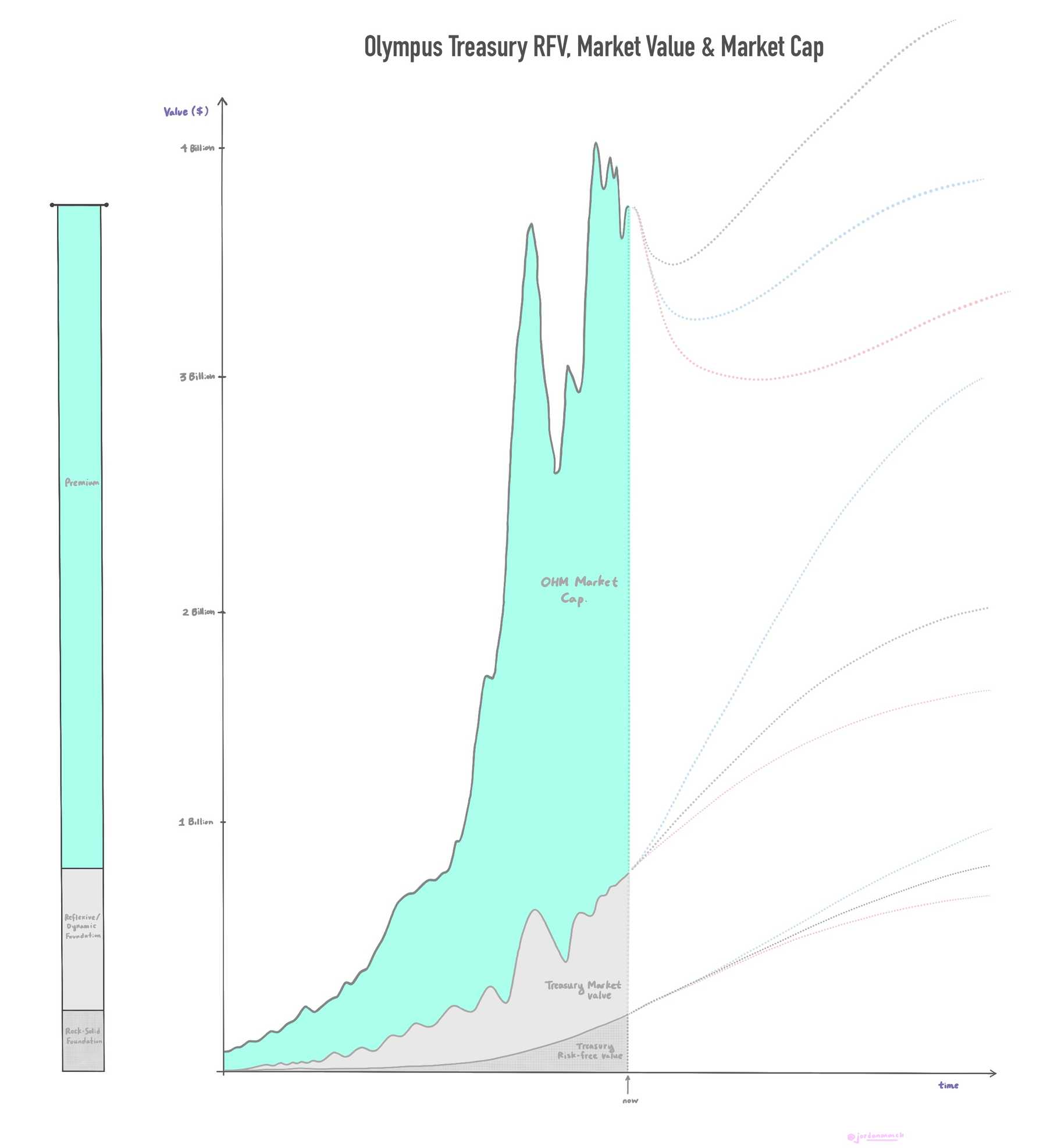

Well, the treasury value basically sets a floor on OHM market cap, right? OHM is unlikely to trade below the total value backing it. The market also places some premium on OHM above the treasury value backing it. So if we want to project market cap into the future, we just need to project the treasury growth, and the premium.

treasury_value + premium = market_capThe diagram below illustrates this relationship clearly (I hope). The gray treasury is the foundation of OHM value. The dark gray, risk-free portion is the rock-solid part of the treasury — these assets never lose value. Above that is the non-stable part of the treasury. These assets still provide a solid backing to OHM, but their value depends on market conditions. The green area is the premium above treasury value that the market places on OHM, and the line right on top of that is the total market cap. Finally, the dotted lines are example projections of treasury value and market cap out into the future.

OK, if we’re long-term investors we really only need to think about the treasury growth, not the premium. The premium should decrease over time, and ultimately approach zero ie. the OHM market cap should tend toward the value of the treasury itself. Why would you pay $100 for $50 worth of underlying assets if you didn’t expect treasury growth to make up for that difference? Some premium will probably persist, but I doubt it’s more than a few percent.

So it’s all about treasury growth. What we should do is try to estimate the treasury growth curve, then discount that value back to the present, and discount all that by some uncertainty and risk factor, and that should then be the fair present day valuation of OHM.

In fact, I would argue that, in a rational market, that’s exactly what the premium over treasury is doing. The premium is reflecting some estimated future treasury value, discounted back to the present, and adjusted for risk etc.

Is this market rational? Doesn’t seem rational. Is OHM mis-priced? Depends on your treasury projection. How big could treasury get? I mean, the super giga bull case is that crypto replaces tradfi/fiat, and then OHM is reserve currency of all that. So trillions I guess? Slim chance of that, but massive upside. The bear case is that it doesn’t grow at all… So which is it? I don’t know, somewhere in between? lol. I don’t know what values to plug into this model, but I think the model is correct.

Conclusion

So, yeah. OHM is a long shot. No doubt about that. But upside is huge. So I’m going to hold a small stack long-term. Is is a ponzi? I mean, yeah kinda. But it also has an end-game use-case so not really. Also, money is kind of a ponzi right? If OHM is trying to be money then it’s gonna be a bit ponzi innit.

Follow me: twitter.com/jordanmmck